20 years of Value-Holdings Deutschland Fund with VP Fund Solutions: Impressive success for value investors

The "Value-Holdings Deutschland Fund", for which Value-Holdings Capital Partners AG acts as investment advisor, was launched in 2002 and has now been on the market for 20 years. The fund invests in listed companies in Germany. The individual companies are selected exclusively according to the value investing strategy.

Value investing or value-oriented investing refers to strategies in which investment decisions are made depending on the value of the investment instruments. Value investors assume that investment instruments such as shares, bonds or real estate have a market price and a value based on the real economy, the so-called intrinsic or fair value. However, market prices often do not adequately reflect this value. Therefore, equity securities of such companies are regularly bought whose stock market prices are below the intrinsic value and which are therefore fundamentally undervalued.

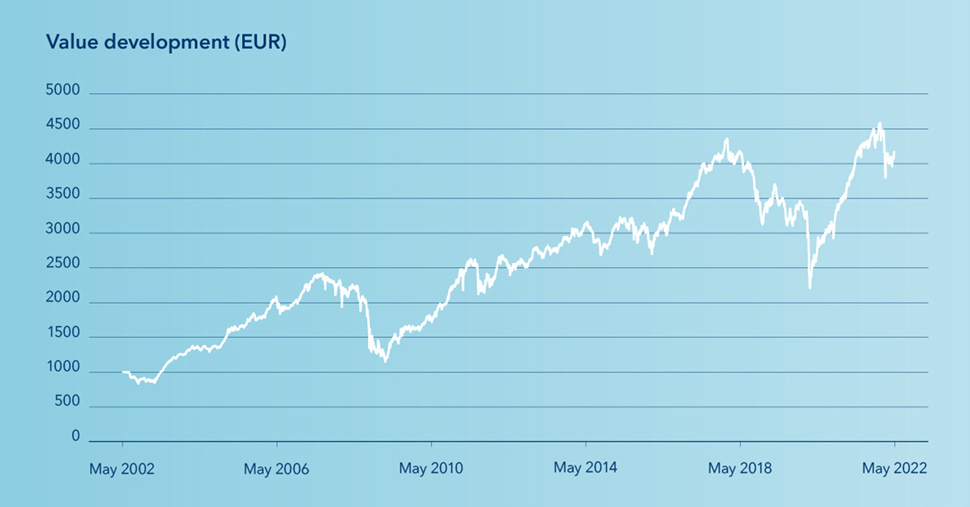

Impressive performance

The fund's performance shows an extraordinary increase of 306.42 per cent since its launch in 2002 (annualised: 7.18 per cent).

"This fund is one of the oldest products on our platform and has a very pleasing track record for its investors. As an established player, we are pleased about the long-standing, successful cooperation with Value-Holdings Capital Partners AG from Augsburg."

Wolfdieter Schnee Head of Fund Client & Investment Services and CEO VP Fund Solutions (Liechtenstein) AG a.i.