Emerging markets reappraised

It is not yet possible to speak of a post-Corona world, but the global economy is already on the upswing. In the past, these were good times for emerging markets.

So the time is right to take a closer look at the broad group of emerging markets. But not all emerging markets are the same. We have known this not only since the BRIC hype, triggered by a study published 20 years ago by the investment bank Goldman Sachs.

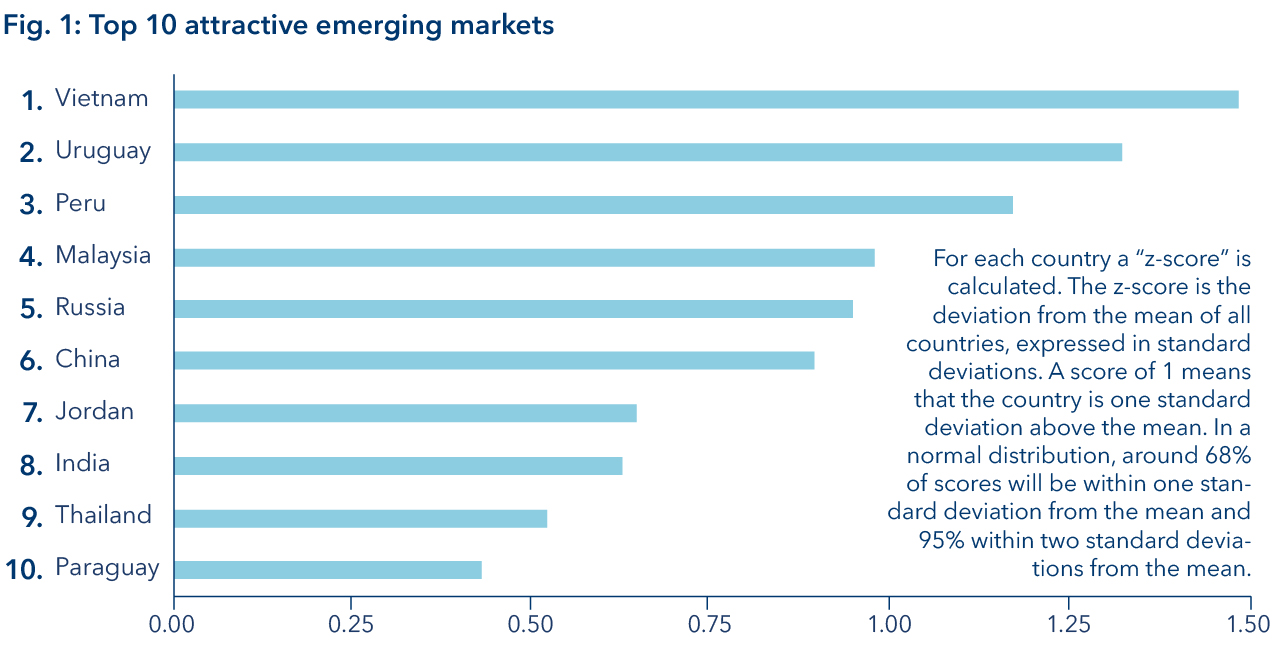

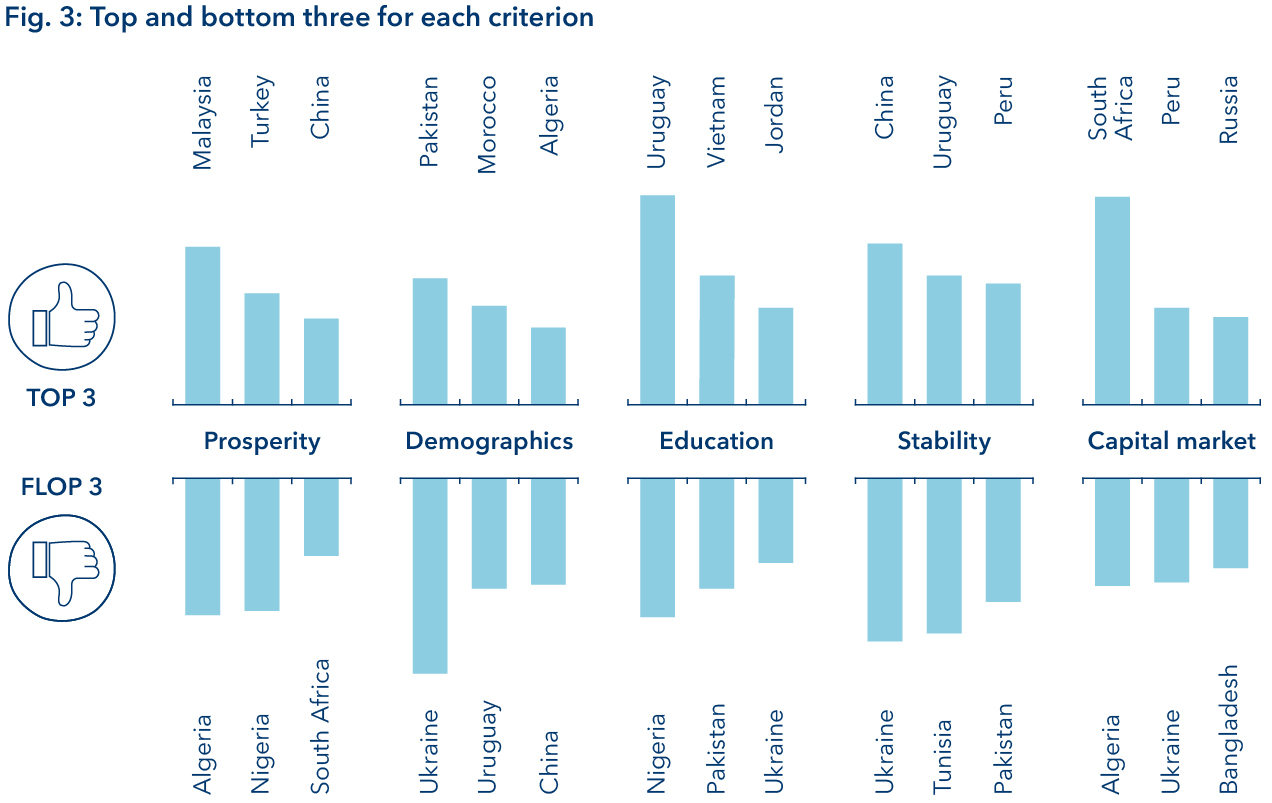

That is why we have assessed selected emerging markets for their attractiveness for investors in the new issue of our investment magazine "Telescope". In order to evaluate them in a differentiated but not isolated manner, we defined five criteria and combined them into one indicator: Prosperity, Demographics, Education, Stability and Capital Market. This makes it possible to compare the selected 28 countries with each other and to draw up a ranking of attractiveness (the entire ranking is available in the magazine, at vpbank.com/telescope).

The winner is the Southeast Asian country Vietnam, followed by two states that may seem somewhat surprising at first glance: Uruguay and Peru. Less surprising, however, is the bottom of the ranking: There we find Ukraine in last place, Nigeria second to last and Tunisia in third to last place.

Because such a ranking does not exist in a vacuum, we therefore asked ourselves which topics, besides Corona and the economic recovery, could be formative in the coming years.

For this purpose we formed three groups:

- emerging countries of the Association of Southeast Asian Nations ASEAN.

- emerging countries of Latin America in the middle-income trap

- five fragile emerging countries with current account deficits.

Of these three groups, the first is our favourite. Groups two and three make it clear that emerging markets are very diverse and, as in the example of Brazil or Indonesia in connection with agricultural products, issues arise that go beyond classical financial analysis as a basis for decision-making.

What all the countries in our ranking have in common is that the current economic cycle, which we call the green recovery because of the investment programmes in industrialised countries ("Telescope" No. 2, December 2020), offers a new opportunity to move closer to the industrialised countries. A major hurdle on this path, however, is the Corona pandemic.

Emerging economies often do not have the financial capacity to put together huge fiscal policy packages to support the economy while rapidly addressing the health crisis. We must therefore assume that, depending on the development of contagions and vaccination progress, Covid-19 will set individual countries back in our ranking.

It is undisputed that emerging countries will continue to gain weight in the coming years. In our view, this should also be reflected in the portfolio by giving emerging markets the importance they deserve.